Treatment of Dividends in Financial Reporting This account records all dividends paid by the company to its stockholders during a given period. In the case of publicly-traded security, dividends are reported on the income statement in the "distributions to shareholders" account. What's the process of accounting for dividends?Īccounting for dividends is a relatively simple process. Investors should consult with their tax accountant before investing in companies offering a dividend.

Note: A dividend represents income received by investors and is not always taxable by federal and state governments. On the other hand, if a company pays a dividend from retained earnings, then it is recorded on the balance sheet as both an asset and liability entry. If a company pays a dividend by distributing income from current operations, the transaction is recorded as an operating activity on the cash flow statement.

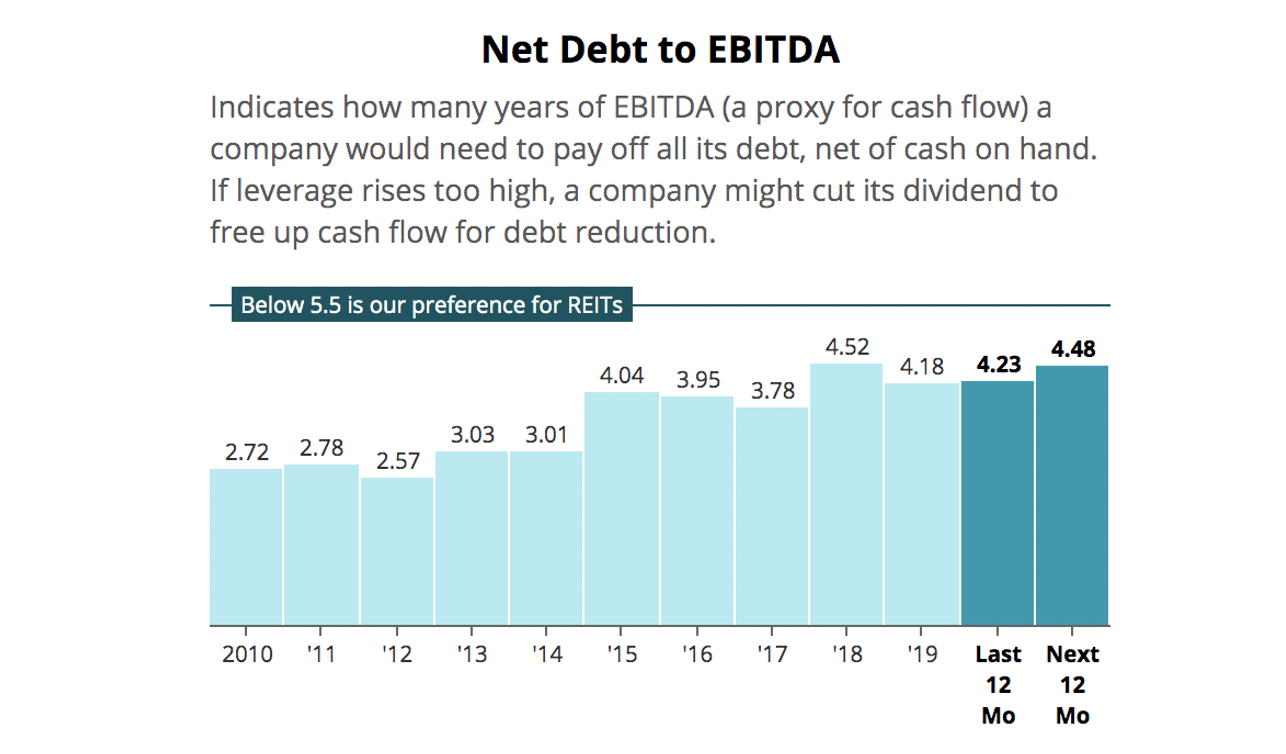

The accounting for dividend payments depends on whether or not the dividends are paid from current or retained earnings. If you have substantial retained earnings, your company might be hesitant to pay out that money in dividends for fear of having insufficient funds for future buying opportunities. Retaining earnings can lead to growth, but it also means that the company has less cash on hand. When companies do not pay out dividends, they retain earnings.

Are dividends an expense how to#

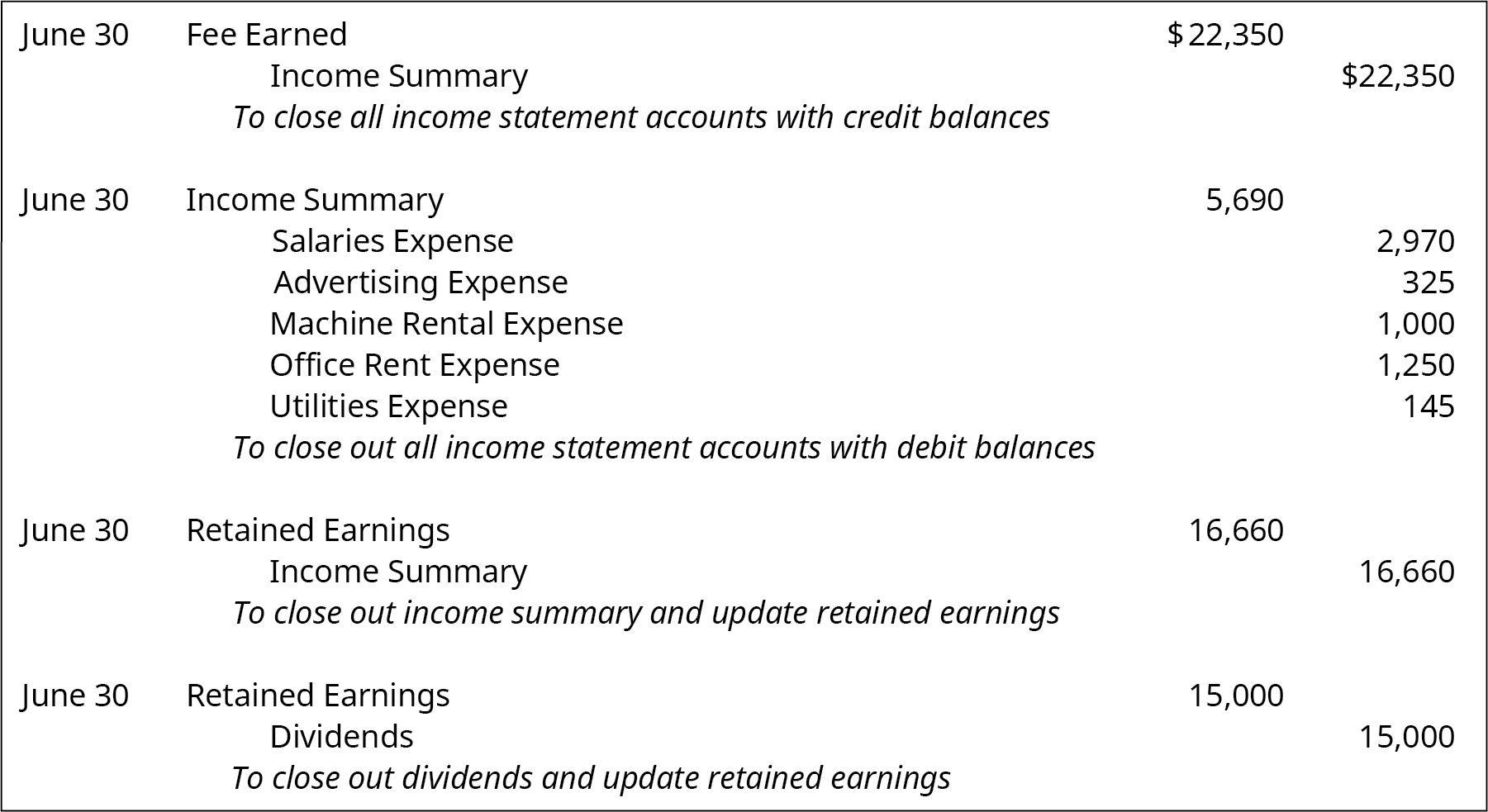

This guide will take you through how to account for dividends properly.Īccounting for dividends is necessary to maintain the company's financial health and satisfy shareholders. The distribution is recorded on the company's balance sheet, affecting the operating cash flow statement. When a company pays a dividend to its shareholders, it's considered a distribution. How is accounting for dividends significant? The total amount must equal the stockholder's equity at any given time. The difference between retained earnings at the beginning of an accounting period and retained earnings at the end of an accounting period is divided into capital contributed by stockholders and earnings distributed to stockholders. Whether or not the company has enough cash on hand to distribute a dividend, it must remove the amount distributed from retained earnings and add it to stockholders' equity. The amount of money needed to pay a dividend is called the required payout ratio. If not, it must borrow money or sell assets to raise cash. This allows the company to track how much its profits are distributed to shareholders.Īccounting for dividends starts with determining if the company has sufficient cash on hand to distribute a dividend. The company must remove the amount paid from its retained earnings account and credit it to the stockholders' equity account when the payment is made. What is accounting for dividends?Īccounting for dividend payments is a critical part of the cash flow process in any business. This amount depends on whether the dividend is classified as a cash or stock dividend, whether it is a regular or special dividend and whether it will be split. The amount of the dividend per share must be determined before it can be recorded in the P&L. The company's profit and loss statement ("P&L") contains amounts for the dividends declared and paid during the year and the dividends claimed but not yet paid. What's significant for the investment strategy for accounting for dividends?Ī dividend is a payment made to a shareholder in proportion to the number of shares they own in a corporation.What are the tips required for accounting for dividends?.

What are the standard ways for accounting for dividends?.What are the benefits of accounting for dividends?.What are the different methods for calculating in accounting for dividends?.

0 kommentar(er)

0 kommentar(er)